6

World Cement

North America 2019

construction should grow by 4% in 2019, with

the predominance of activity being generated by

industrial and institutional construction, according

to the American Institute of Architects’ consensus

construction forecast. This forecast shows slowing

commercial building construction and is lower

than expectations of 4.7% growth in 2018. Again,

labour constraints, as well as the high cost of

materials and land, support Moody’s stable view for

private non‑residential construction over the next

12 − 18 months.

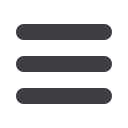

Public infrastructure

Public infrastructure spending remains robust,

particularly at state level. Construction spending in

the public sector has grown since late 2017, reaching

11% year-on-year growth as of September 2018

(Figure 1). Continued, albeit somewhat slower,

growth of 8% is expected in 2019, as states continue

to pass new long-term legislation supporting highway

construction. For example, in November 2018,

California voters rejected a repeal of Senate Bill One,

also known as the Road Repair and Accountability Act

of 2017. This is a gas tax increase passed to help pay

for highway infrastructure throughout the state.

At the federal level, the Fixing America’s Surface

Transportation Act will provide funding until 2020

for public infrastructure, close to 75% of which is

allocated to the Federal Highway Administration.

Moody’s remains cautious on public infrastructure

spending growth beyond 2020, particularly at the

federal level, as other agenda items will likely take

priority during an election year.

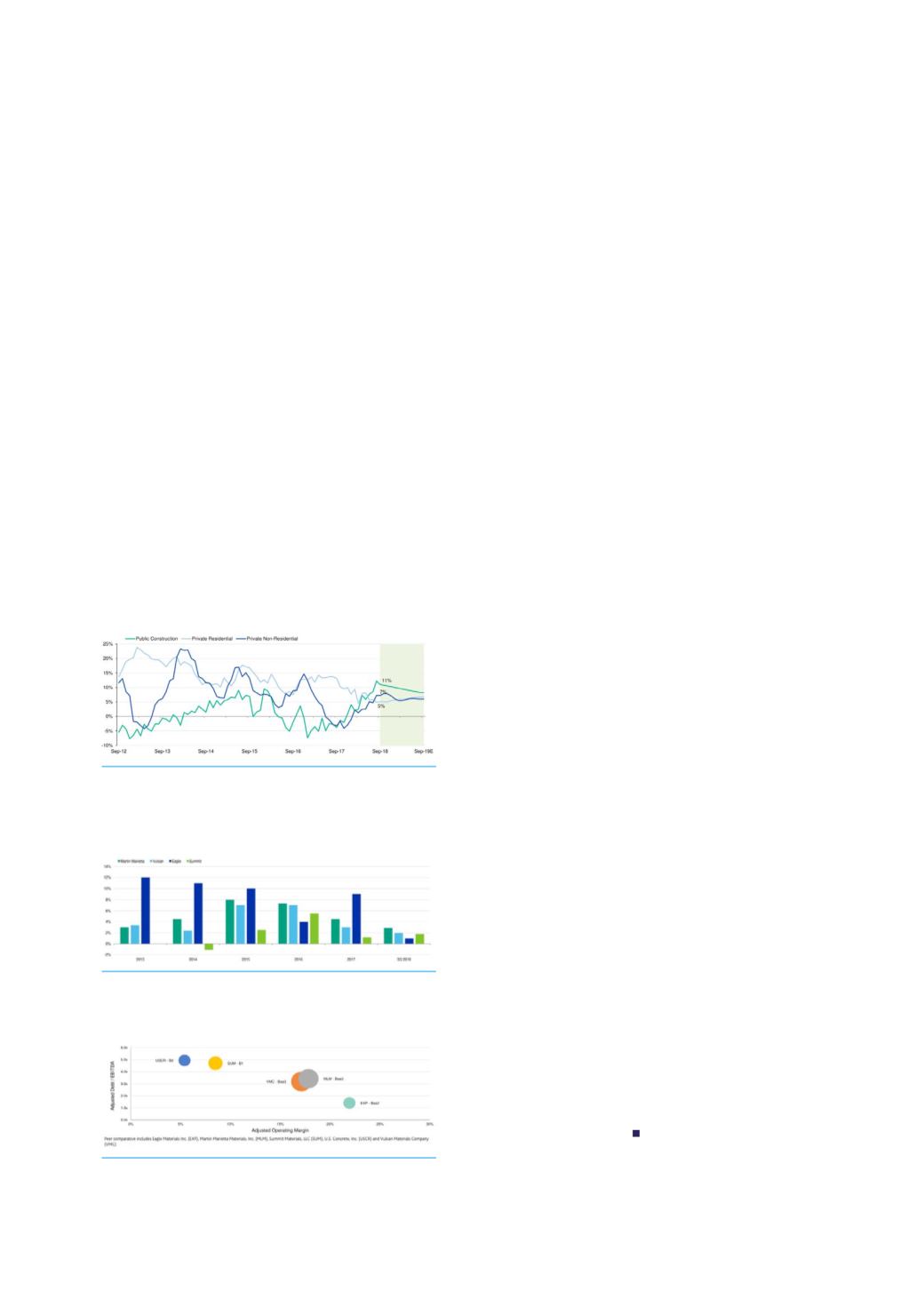

Overview

Price increases have largely moderated, but still remain

positive. The ability of building material companies to

increase prices across all products has diminished

in 2018, and is another indicator of tempering in the

sector. Aggregates pricing growth is currently in the low

single‑digits (Figure 2). On the positive side, pricing and

volume growth is helping to offset labour constraints

and higher material costs on margins. In addition, the

rated building material companies continue to report

strong backlogs, despite weaker earnings in 2017 and

2018 due to the weather.

Product mix continues to shift towards

aggregates. Several building materials

companies rated by Moody’s have either

increased their percentage of revenues coming

from aggregates, or recently made major

acquisitions in the aggregates space. These

include Vulcan Materials Co. (Baa3 stable),

Martin Marietta Materials Inc. (Baa3 negative), and

US Concrete Inc. (B2 stable). Restrictive permitting

processes in most metropolitan areas and high

transportation costs make the aggregates industry

very regional in nature and limit competition.

Accordingly, aggregates producers benefit from

better pricing power through cycles, compared to

sellers of cement and ready-mixed concrete.

Solid credit metrics and strong liquidity have helped

to mitigate volatility in earnings. The Moody’s-rated

US building material companies have good credit

profiles, with leverage that has generally trended

down over the last decade. Internal liquidity is strong,

with minimal near‑term maturities, high levels of cash,

and line availability. Furthermore, the building material

companies have strong cash flow generation, with a

demonstrated ability to generate positive cash flows

during economic downturns.

Conclusion

Moody’s could revise its outlook back to positive

if the industry’s organic operating income growth

increases above 7%. This is coupled with continued

solid momentum in public, private residential, and

private non-residential construction, as well as stable

federal highway spending. However, the outlook

could change to negative, if the industry’s organic

operating income contracts by 3% or more, if there is

a reversal in end market momentum, and/or if there is

a reversal of broader economic indicators pointing to

recessionary conditions.

About the author

Griselda Bisono is a Vice President

–

Senior Analyst in

Moody’s Corporate Finance Group.

Figure 1. Total construction put in place

(year-on-year change). Public construction

spending growth is expected to outpace private

construction spending growth.

Figure 2. Aggregates year-on-year change.

Pricing growth has largely moderated, but

remains positive.

Figure 3. Moody’s adjusted debt/EBITDA and

operating margins. Solid credit profiles support

current credit ratings.