10

World Cement

North America 2019

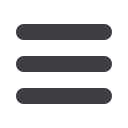

of almost 2%, the US is now approaching

zero growth. If not for immigration, the

country would already be at zero growth.

SC Market Analytics’ (SCMA) estimate for

future population growth is under 0.5%

through to 2024. Part of this is due to the

continued decline in domestic births per family

and part is due to lower immigration. When

used in isolation, it means a slowdown in

cement consumption. But this article will look

at the other factors behind cement demand

growth to see if they counter this drag from

slow population growth.

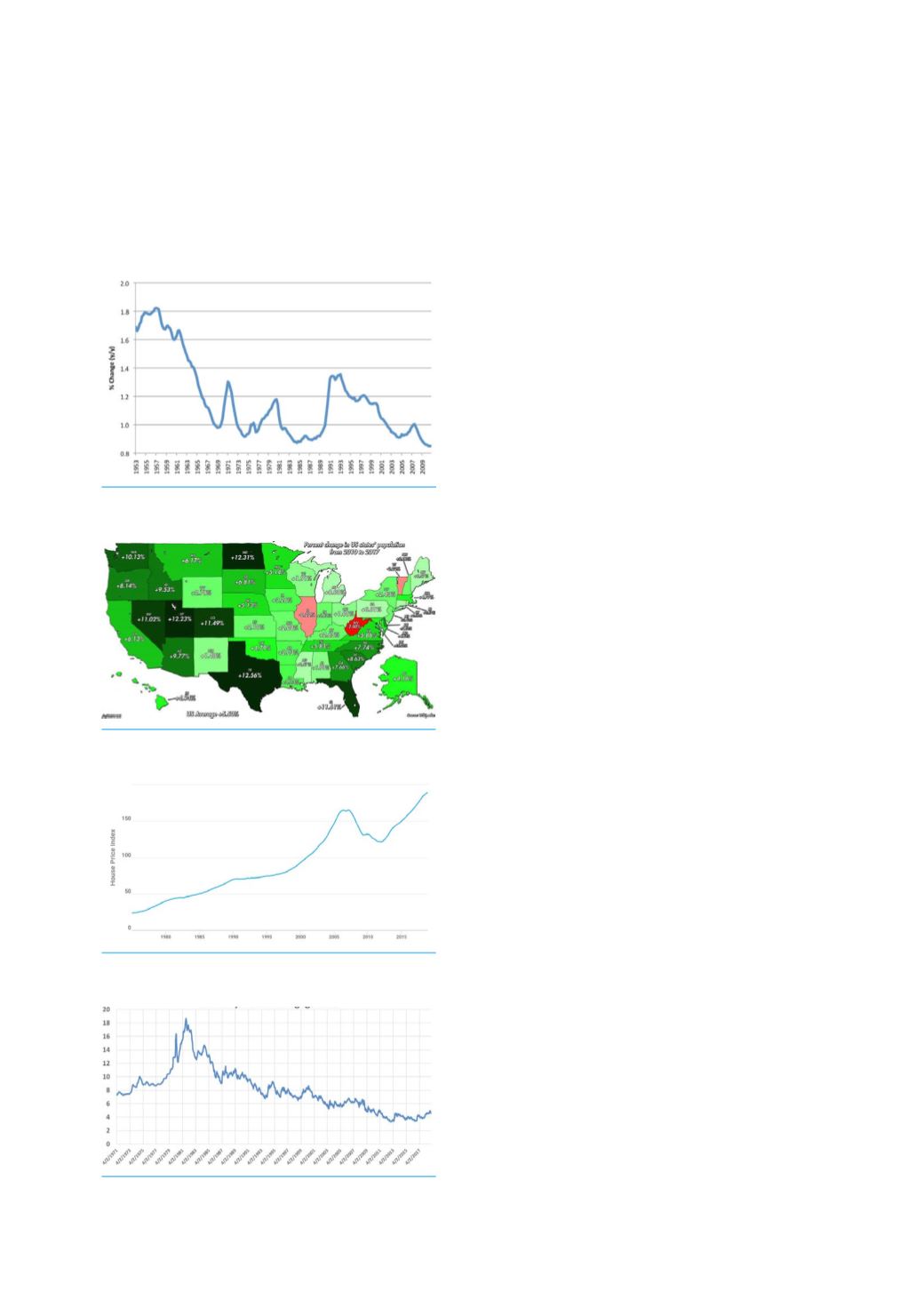

Another driver of cement demand is

migration among counties and states.

Large migration movements boost cement

demand for any given rate of population

growth, since growing areas need more of

all the construction segments (residential,

non‑residential, and non-building). Future

migration patterns will look like past migration

patterns with a few wrinkles. The Sunbelt will

continue to attract new people and companies,

due to lower taxes, lower home costs, and

lower business costs. In most cases these

attractors are getting stronger.

The Mountain states can now be added

to the list of destination sites for movers.

Lots of outdoor recreation, along with many

of the same attractors as the Sunbelt, is

boosting growth in the Mountain states.

More modest changes include improvements

in the old Rustbelt, due to a resurgence in

manufacturing, and slower growth along the

West Coast, as high prices and increasingly

restrictive business rules discourage business.

Areas that will do poorer are high tax, colder

areas of the country.

Housing is the largest investment and

asset for most families. Figure 3 shows that,

over time, housing has been a reasonably

good investment. However, the chart also

shows that rapid housing price growth

is unsustainable. Housing affordability is

impacted by mortgage rates, income growth,

and housing prices. The US is now in another

phase of high price growth experienced over a

short period of time. If the past is a prologue,

then the next five years will see little price

appreciation for the vast majority of areas.

But without a major economic downturn on

the horizon, price stagnation during the next

five years is more likely than a catastrophic

30% decline. Given that personal incomes are

growing, this will lead to more qualified buyers

but fewer buyers prepared to buy at the top

of the market. Hence, flat to somewhat slower

new home building activity is anticipated over

the next five years.

During the last 50 years, the federal budget

has only been balanced (or in a surplus

position) for four of those years. There

are multiple reasons for this: fast or slow

economic growth, wars, environmental

programmes, social programmes, etc.

No matter what the reason, spending has

almost always outpaced receipts. Since this

behaviour is unlikely to change, according to

Figure 1. Growth rate of the US population

(%/year).

Figure 2. Percent change in the population of

US states from 2010 to 2017.

Figure 3. Housing price index (Freddie Mac

2000 = 100)

Figure 4. US 30 year fixed mortgage rate.