12

World Cement

North America 2019

SCMA, the debt to GDP ratio will continue

to increase somewhat. This means the US

will never pay down its National Debt. This is

not an intractable problem as long as interest

rates remain low. The outlook is for low

interest rates (a 10 year treasury rate below

4%) to continue. This means a debt crisis will

be avoided for the next five years at least.

With the current tax environment and

policies, GDP growth should be able to grow

by near 3%/year for the next four years.

This is very unusual. It has been growing for

nine years, and adding another five without a

recession is rare. Still, the power of incentives

is underappreciated. For now, the incentives

for investment and innovation are high and will

result in continued rapid capital investments

(both physical and intellectual). There are

dozens of things that could stop this growth

path, but none are high enough to forecast a

low GDP path through to 2024.

Economic background summary

z

z

Population growth is slowing and will

average near 0.5% year-on-year for the

next five years.

z

z

Migration patterns will favour the Sunbelt

and Mountain regions.

z

z

State tax differentials will become even

more important for location decisions.

z

z

GDP growth will average nearly

3%/year through to 2024 (if policies do

not change).

Construction materials drivers

With solid economic growth likely to

continue, conditions are favourable for higher

construction spending through to 2024.

Among the three major segments, however,

only infrastructure spending will move much

higher.

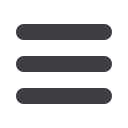

In the non-residential segment, the US

is in a ‘retail ice age’ (a term coined by

analyst Burt Flickinger). Figure 6 shows the

dramatic switch from retail to warehousing:

another impact of the Amazon effect. While

the structural shift is not over, it should be

complete before 2024. This, along with

modest employment growth (the US is already

at full employment), will result in little growth

for non‑residential construction spending

during most of the next five years.

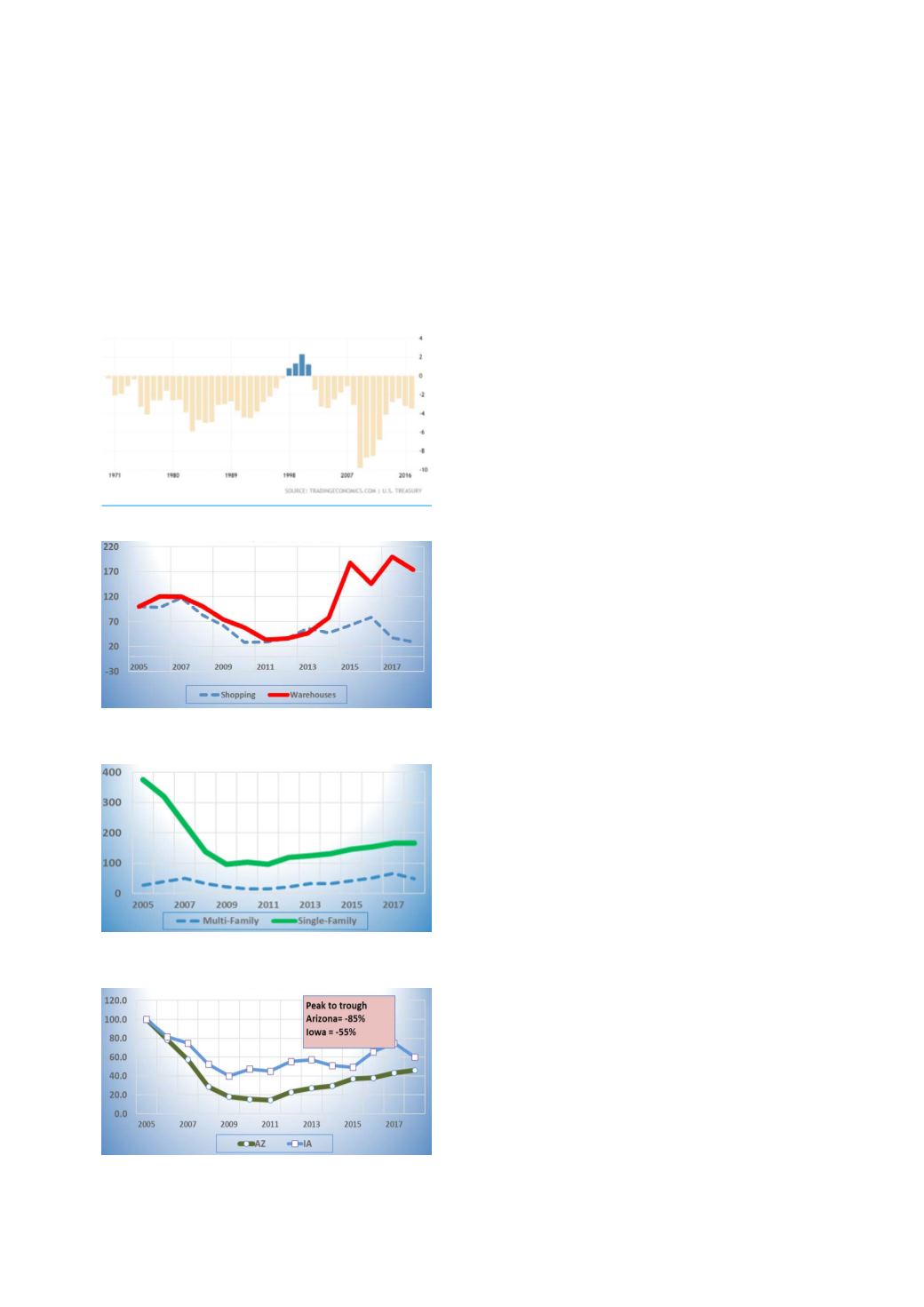

The biggest changes in construction

come from residential, due to its sensitivity

to a variety of factors, but most importantly

to mortgage rates. Within residential, it is

single‑family buildings and suburban areas that

usually have the largest swings.

In addition to the wider variability of

single‑family to multi-family buildings, among

the states there is also a much wider variability

over time. The high flyers (Arizona, California,

Florida, and Nevada) usually have the biggest

drops during a downturn and the biggest

spikes upward during a recovery (Figure 8).

This is one of the reasons SCMA forecasts all

construction materials at the county level: to

capture these nuances. In this way, the roll-up

to metro, state, or national should be more

realistic.

Figure 5. US federal budget defecit to GDP (%).

Figure 6. Warehousing vs retail (2005 to 2018

ft

2

,

indexed 2005 = 100).

Figure 7. Residential building (2005 to 2018,

million ft

2

).

Figure 8. Housing starts (2005 to 2018,

indexed 2005 = 100).