14

World Cement

North America 2019

With many years of growing tax receipts

at all levels of government and the growing

backlog of needs, there is now the ability

to fund more infrastructure work. SCMA’s

outlook for growing cement consumption

depends to a great extent on higher

non‑building demand. The gains are good but

not great because of the drag from higher

pension costs. These costs come first and

will put a dampener on higher public works

spending in those areas with high unfunded

pension liabilities, such as Illinois.

Construction input background

z

z

The main driver of construction growth will

be infrastructure.

z

z

Private work (residential and

non‑residential) will be flat to slightly down.

z

z

The ‘retail ice age’ is almost over.

z

z

States with high unfunded pension

liabilities will struggle to fund new public

works.

US cement demand outlook: 2019 to

2024

The US is past the post-tax cut initial growth

spurt and entering a period where the

longer‑term structural impact may be felt. This

phase, while less dramatic, has long legs and

will show up with continued strength in capital

investments among all classes in this segment

(i.e. machinery, structures, intellectual

investments, and new business formation).

The qualifier is that current pro‑growth

policies continue. Helping to maintain this

higher consumption track is the levelling off

of interest rates (at least for a while). With

the new tax rates and changes now evident

to everyone, the general movement of people

and businesses towards warmer, lower cost

areas will continue. This means the more than

60 year move to Sunbelt states will accelerate

but will also be more spread out, as those

states just North of Florida and Georgia will

capture more of the flow. The increased

attractiveness of most of the Mountain region

states should be added to this.

These economic and business changes

mean that all segments of construction

materials will do well, with residential and

non-residential spending plateauing at high

levels and non‑building providing the bulk of

materials growth over the next two to three

years. Residential is forecast to remain about

flat due to the high price of new housing, a

shift in millennial preferences for renting in

more urban areas, and the lack of adequate

down payments.

For non-residential construction, the

US is still in the disruptive throes of the

Amazon Effect. This is a huge structural

change for retail, and to a lesser extent for

other commercial activity, precluding any

large overall increase in demand from this

segment. The sub-segments of warehousing

and entertainment investments will increase to

almost balance out the decline of traditional

retail space. Non-building is doing well

currently and will do the best over the forecast

horizon. With the economy growing strongly for

several years, local conditions are good enough

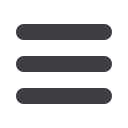

Figure 9. Roads and bridges (2005 to 2018,

US$ billion).

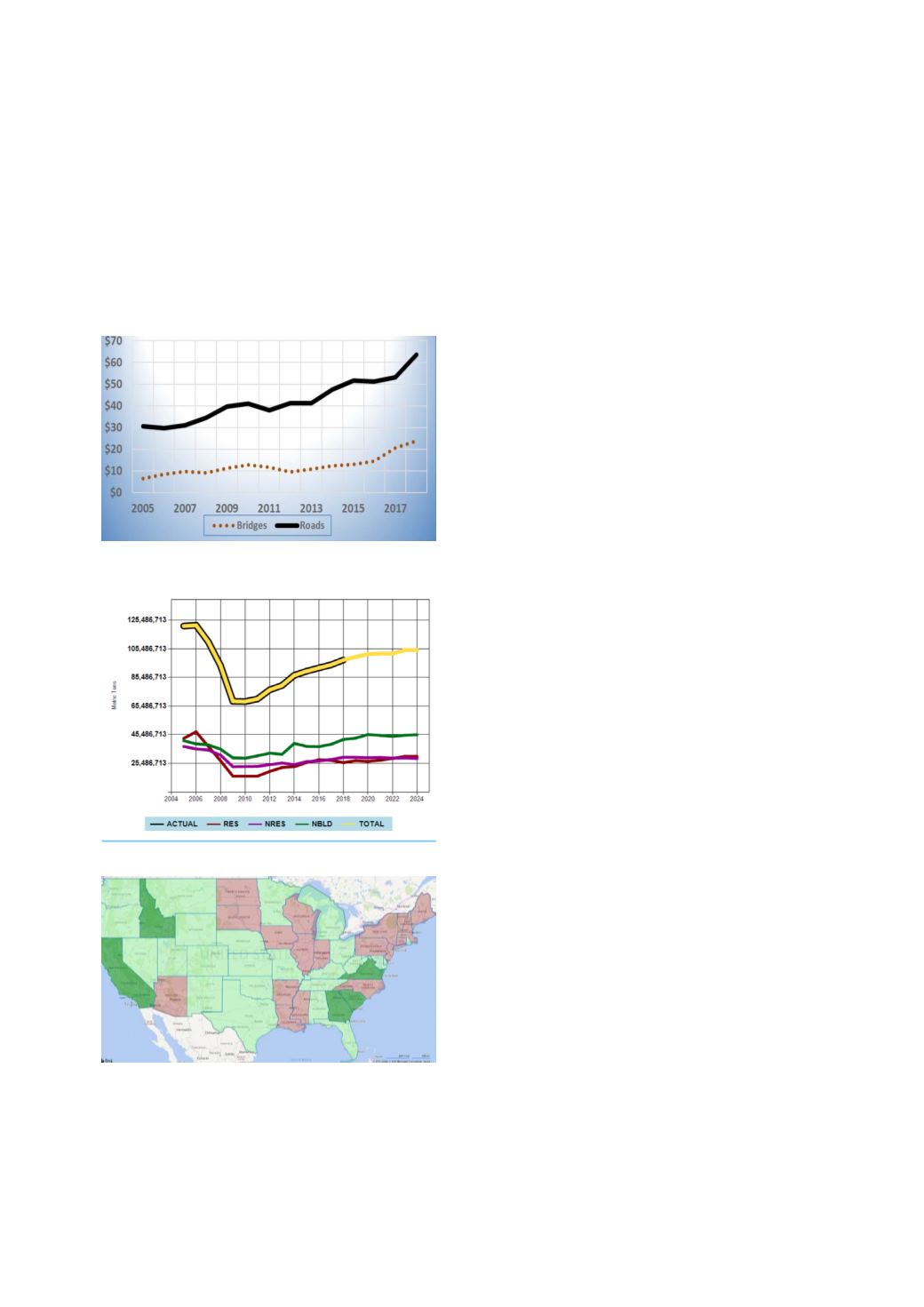

Figure 10. US cement consumption 2016

−

2024.

Figure 11. Total percentage change in cement

demand by state (2019 to 2024). Source:

History USGS, SCMA forecast for portland and

blended cements in tonnes. SCMA estimates

used where USGS shows no values due to

propriety competitive conditions. Green > 0%,

Red <0% between 2019 and 2024.