17

North America 2019

World Cement

practice throughout the study region, SCMA

has used the lowest common denominator

of a 1.05:1 ratio of ordinary portland cement

to clinker in the calculations. Pending further

evidence of US acceptance of limestone

additions, it may be appropriate to increase

the ratio to 1.1:1 in the future. This would have

the effect of adding over 5 million tpy to the

US supply equation.

Supplementary cementitious materials

(SCMs), such as ground blastfurnace slag,

flyash, and silica fume, are used by virtually

all cement customers in the US, in order to

modify the properties and/or cost profile of

the concrete they sell. Again, this is a practice

that has been well established over several

decades. For the purposes of this study, it is

assumed that the proportionate use of SCMs

in concrete will remain essentially constant

over the forecast horizon, and will therefore

not impact the supply equation. It should

be noted, however, that higher limestone

additions in cement would be partially offset by

lower SCM additions in concrete.

International imports supplement regional

capacity

Historically, any cement shortages in the US

have been addressed not only with cement

from Canada and Mexico, but also with

cement sourced from overseas, usually from

the Euro-Med area and from Asia, where

enormous export capacity exists. In the US,

at least 95% of cement import facilities

are owned by domestic producers, who

use them to supplement North American

capacity in times of shortage, often sourcing

the needed volume from plants in the

Euro‑Med area that are owned or affiliated

with their parent companies. This means that

domestic suppliers take care of customers’

requirements for portland cement in tight

markets, whether there is sufficient dedicated

capacity located in North America or not.

There have also been several instances

where major cement purchasers have opened

their own import facilities. Though such

non‑structural international imports of portland

cement will always be a factor in the US

supply equation, they are otherwise ignored

for the purposes of this analysis.

Production vs capacity

The nameplate capacity calculations provide

a somewhat theoretical or best case view of

what plants could be capable of producing

over time, when well maintained and expertly

managed. In addition, it presumes, for

example, an absence of labour disruptions

and average weather patterns. In reality,

equipment breakdowns, labour problems, and

unpredictable weather make it highly unlikely

that every plant will operate for 330 days in

a given year. Ignoring production decisions

that are taken for market reasons, the likely

maximum achievable production in any year is

considered to be between 2% and 6% below

this best case view.

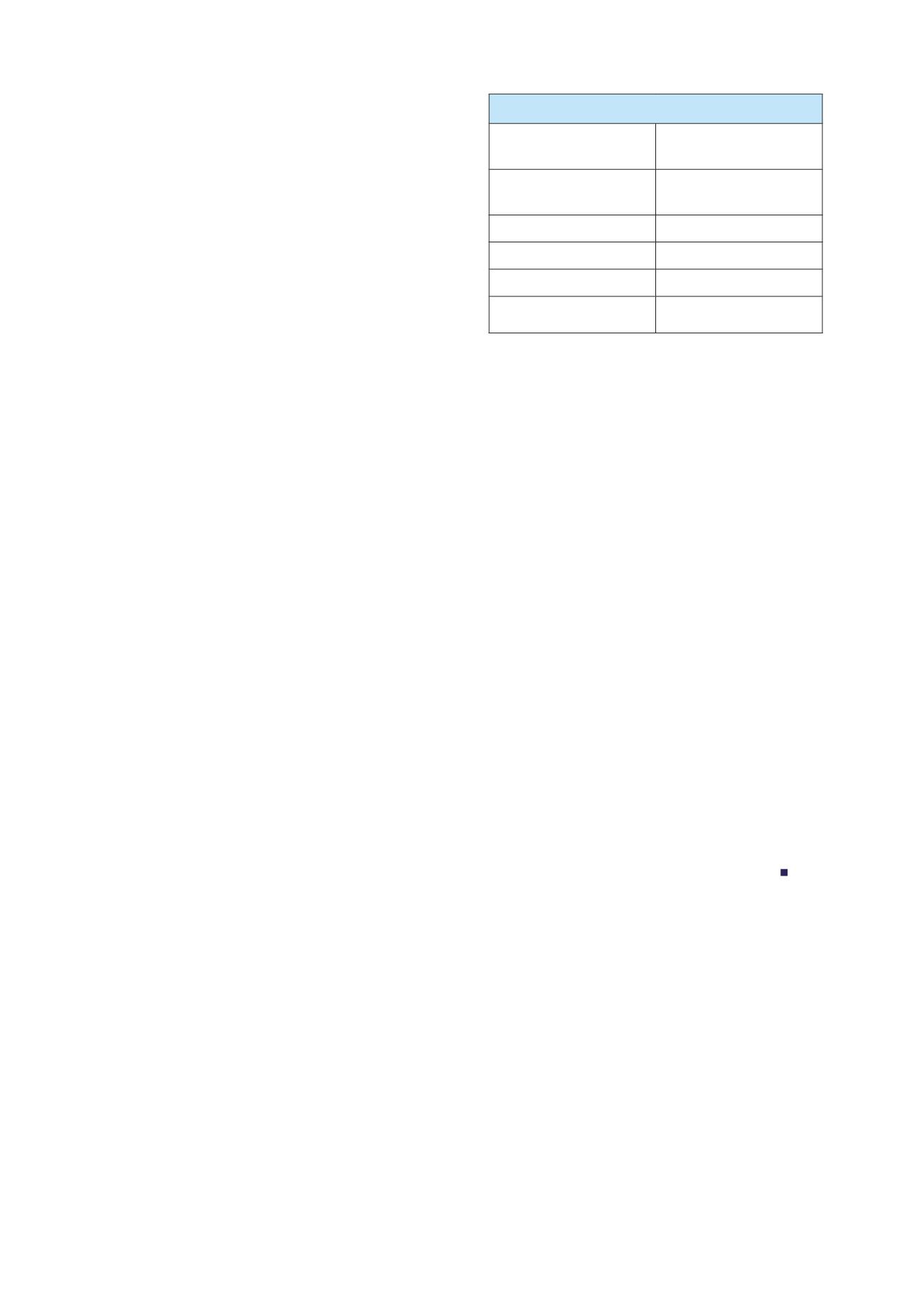

Total structural capacity

Table 2 summarises the conclusions of

SCMA’s US supply analysis. It suggests that

the US industry has capacity to produce up

to 110.5 million tpy of portland cement and

should be able to reliably achieve production

of between 104 million tpy and 108 million tpy.

Conclusion

SCMA’s analysis shows that US portland

cement demand will remain below US

dedicated supply over most of the forecast

horizon. As 2023 nears, demand will finally

approach practical supply levels. However,

under the scenario where 5% additional

limestone addition adds roughly another

5 million tpy to the supply equation, overall US

demand will still fall well short of supply.

About the authors

Dr David Cherub has over 30 years of

experience forecasting North American

construction materials markets. He is

Chief Economist at SC Market Analytics and

has provided specialised economic and market

forecasting services to the cement, concrete,

and aggregates industries since 1996.

Colin Sutherland has over 30 years of experience

in the construction materials sector, primarily

for cement, aggregates, and concrete products.

His areas of expertise include corporate strategy

development, market/competitive analysis,

demand forecasting, and business case

development for large CAPEX projects.

Table 2. Estimated US structural supply (t).

Nameplate US-based

capacity

102 650 000

Dedicated Canadian and

Mexican capacity

7 850 000

Nameplate structural total

110 500 000

Production ~ 94%

103 870 000

Production ~ 96%

106 080 000

Production ~ 98%

108 290 000